In today’s evolving financial landscape, the need for innovative and efficient lending solutions is more important than ever. Traditional banking institutions have often been slow to adapt to the changing needs of consumers, but the rise of cryptocurrencies and blockchain technology is opening up new possibilities.

For example, in the UK market, the future of crypto lending looks promising. As more people become familiar with digital currencies like Bitcoin and Ethereum, they are starting to see the benefits of using these assets as collateral for loans. By moving away from traditional banknotes and into the world of digital currencies, individuals and companies can access lending opportunities that were once out of reach.

One of the key catalysts for the growth of crypto lending is the unique nature of blockchain technology. Unlike traditional banking systems where transactions are recorded and stored in centralized databases, blockchains distribute and decentralize the recording and verification of transactions. This not only enhances security but also improves the efficiency and transparency of the lending process.

In addition to the technological advancements provided by blockchain, there are other fundamental factors driving the future of crypto lending in the UK. Rising interest rates and the increasing cost of traditional lending from banks have made people more willing to explore alternative lending options. The lack of stringent governance and regulatory parameters also allows for more flexibility and innovation in the market.

Furthermore, the rise of cryptocurrencies has created an entirely new asset class for investors. While traditional banking systems often require collateral in the form of physical assets or money, digital currencies represent a new form of value. Investors are willing to lend their cryptocurrencies based on the belief that the value of these assets will increase over time, presenting an opportunity for both lenders and borrowers.

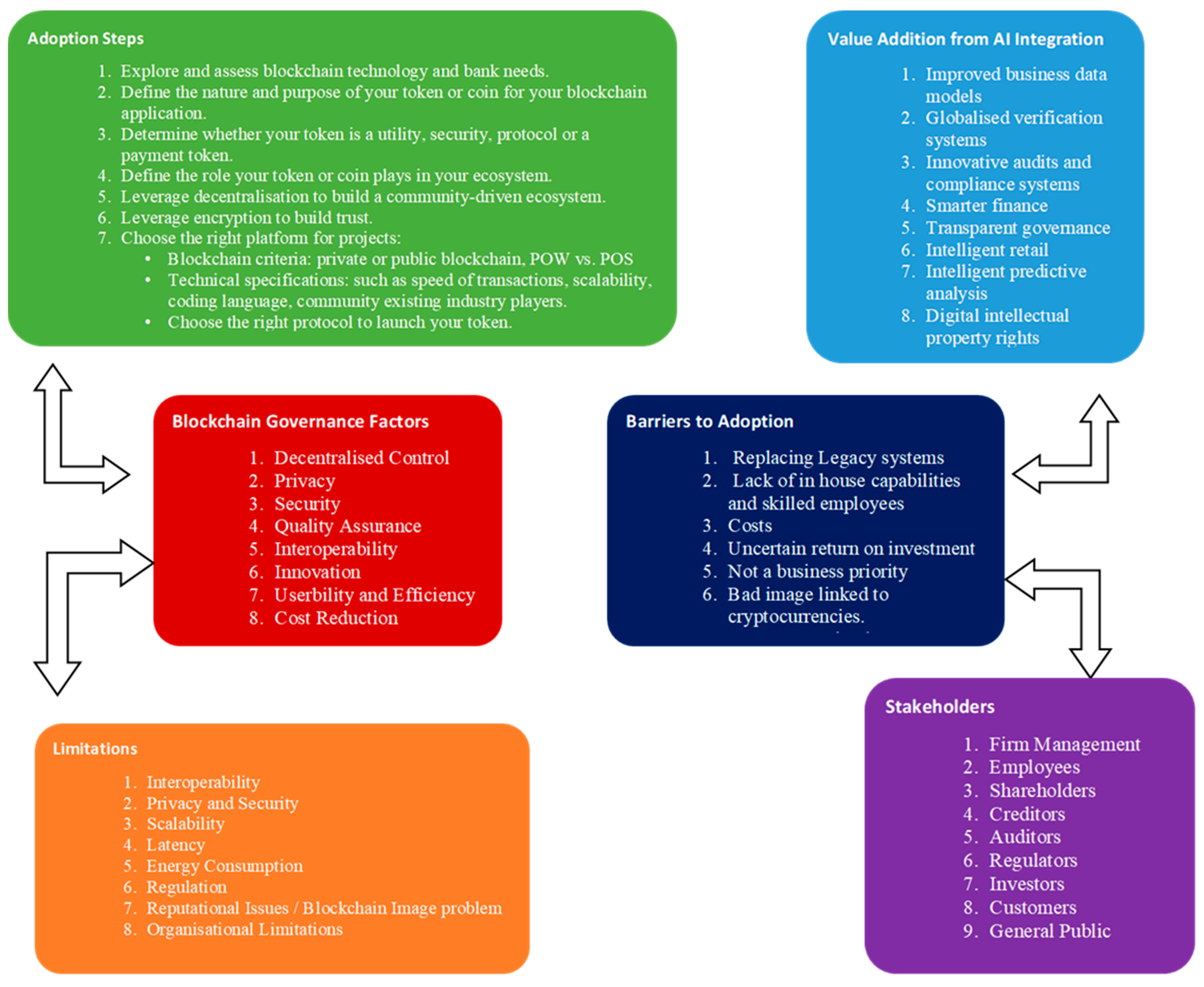

As the UK continues to embrace the possibilities of crypto lending, companies are building platforms and services to cater to this demand. Banks and other financial institutions are exploring ways to integrate blockchain technology into their core banking applications, recognizing the potential for improved efficiency and reduced costs.

In conclusion, the future of crypto lending in the UK is bright. With the advancements in blockchain technology and the increasing interest from investors and borrowers, the traditional banking landscape is set to change. As more people embrace cryptocurrencies and explore new lending opportunities, we can expect to see a shift towards a more digital and decentralized financial system.

Crypto Catalysts Ahead

In the realm of crypto lending, catalysts play a vital role in shaping the future of the market. These catalysts are the core drivers behind the evolution of the industry, and they have the power to transform the financial landscape.

Unlocking the Potential of Blockchain

Blockchain technology is one of the most significant catalysts in the crypto lending market. With its decentralized network and immutable database, blockchain provides a transparent and secure platform for financial transactions. This technology eliminates the need for intermediaries and opens doors for new lending applications.

For example, blockchain has the potential to change the way traditional lending platforms operate. It can remove the central authority and bring a uniformity in pricing and interest rates. This would give investors and borrowers more control over their transactions, and it could also lead to lower borrowing costs.

The Rise of Web3

Web3, the next phase of the internet, is another catalyst that is reshaping the future of crypto lending. Web3 aims to decentralize the web by providing users with more control over their data and digital identities. This technology allows for the seamless transfer of assets and interests across different platforms.

With Web3, investors can have a more holistic view of their assets. They can track their investments, monitor their performance, and make informed decisions. Additionally, Web3 has the potential to create new lending platforms that are more efficient and user-friendly.

The Changing Monetary Landscape

The monetary landscape is also a catalyst for the future of crypto lending. As central banks around the world explore the possibility of issuing their own digital currencies, the traditional fiat currencies might undergo significant changes. This could result in a shift in how money is stored, transferred, and lent.

For example, the introduction of central bank digital currencies (CBDCs) could give rise to new forms of lending and borrowing. CBDCs could be used as collateral for loans and could enable instant and borderless transactions. This would provide individuals and businesses with more flexibility in managing their finances.

In conclusion, the future of crypto lending is bright, and the catalysts mentioned above are just a few examples of what’s to come. As the market continues to mature, investors and borrowers can expect to see innovations and advancements that will further enhance the efficiency and accessibility of crypto lending.

The Need for a Digital Pound

Our mission is to revolutionize the financial industry by embracing digital currencies and exploring new ways of lending. As we look ahead to the future, we recognize the rising popularity of cryptocurrencies and the potential they hold for transforming the lending landscape. However, to fully realize this vision, a digital pound is likely to be needed.

Fulfilling our Mission

In order to fulfill our mission, we understand the importance of having a digital pound. With the fast-paced advancements in technology and the growing demand for digital transactions, traditional banknotes are no longer sufficient. We need a digital currency that can be easily deployed and integrated into our databases, allowing us to adapt to the changing parameters of the financial market.

A digital pound would serve as an anchor in the crypto lending network, providing stability and governance. Unlike other cryptocurrencies that often fluctuate in value, the digital pound would be backed by the monetary force of the Bank of England, ensuring its reliability and trustworthiness.

Rising Interest in Crypto Lending

Over the past few years, we have seen a significant increase in interest in crypto lending. More and more people are realizing the potential of these assets and are eager to explore the opportunities they present. However, without a digital pound, many individuals and businesses are hesitant to fully commit to the crypto lending market. They want the security and familiarity of a national currency, such as the pound, to protect their interests.

By having a digital pound, we can bridge the gap between the traditional banking system and the world of crypto lending. We can offer our customers the stability and security they desire, while also providing them with the flexibility and high interest rates that the crypto lending market offers.

The Future of Crypto Lending

The future holds great potential for the crypto lending industry. With a digital pound in place, we can expect to see a surge in lending activity as more individuals and businesses embrace the benefits of digital currencies. This will not only attract new customers but also encourage existing players to move their capital from the sidelines and actively participate in the market.

As we continue to explore new financial trends and catalysts, it is clear that a digital pound is a key enabler for the future of crypto lending in the UK. It is a necessary step forward in aligning traditional banking with the exciting possibilities of blockchain technology and digital assets.

Capital moving to the sidelines — or to other assets

As the crypto lending industry in the UK continues to evolve, one of the core issues being faced by lenders is money moving to the sidelines or being invested in other types of assets. This shift in capital allocation can be seen as a result of various catalysts, including changes in pricing, governance, and regulatory parameters.

In the past, investors were often forced to move their capital out of traditional banking systems and into digital assets like cryptocurrencies. However, with the rise of Web3 applications and the growing interest in decentralized finance (DeFi), there are now more options available for those who want to fulfill their financial needs without being limited to traditional banking.

These new applications represent a paradigm shift in the way transactions are conducted and funds are deployed. With the use of blockchain technology, these applications can now give investors the ability to earn interest on their crypto assets, borrow against them, or participate in various trading and lending deals.

One of the key catalysts for this shift in capital allocation is the current low interest rate environment. With central banks keeping interest rates low, investors are often looking for alternative ways to generate returns. Crypto lending offers a potential solution, as it allows individuals to earn interest on their crypto assets by lending them to others in the crypto ecosystem.

Furthermore, the recent rise in the value of cryptocurrencies, like Bitcoin and Ethereum, has also played a significant role in attracting capital towards crypto lending. As these digital assets appreciate in value, lenders can earn even higher returns, making crypto lending an attractive option for those looking to generate income.

Overall, the future of crypto lending in the UK is likely to be shaped by various catalysts that are driving capital towards the crypto ecosystem. Whether it’s the need for higher returns, the desire for decentralized financial applications, or simply a change in interest rates, these catalysts are likely to force traditional lenders to adapt and improve their offerings to stay relevant in this evolving market.

What Will Be the Future of Crypto Lending

The current financial landscape is rapidly transforming as digital currencies continue to gain traction. Cash is no longer the core source of transactions; instead, digital assets and cryptocurrencies are taking over. At our company, we understand the need for innovative solutions in this new monetary network.

As the demand for digital assets grows, traditional banking systems are being forced to adapt. However, they are often limited by their centralized governance and slow response to market changes. In contrast, crypto lending companies like ours are building a new force in the lending market, fulfilling the high demand for capital in a fast and efficient manner.

Investors and individuals from all walks of life are now looking to invest their pound sterling into crypto assets. This is in light of the changing financial parameters and the need for a more decentralized monetary network. While some people may still be on the sidelines, the majority understand the potential that crypto lending holds.

What sets us apart is our innovative approach to lending. We offer competitive rates and ensure transparency and security in all our deals. Our crypto lending platform is designed to facilitate easy borrowing and lending, taking full advantage of the blockchain technology.

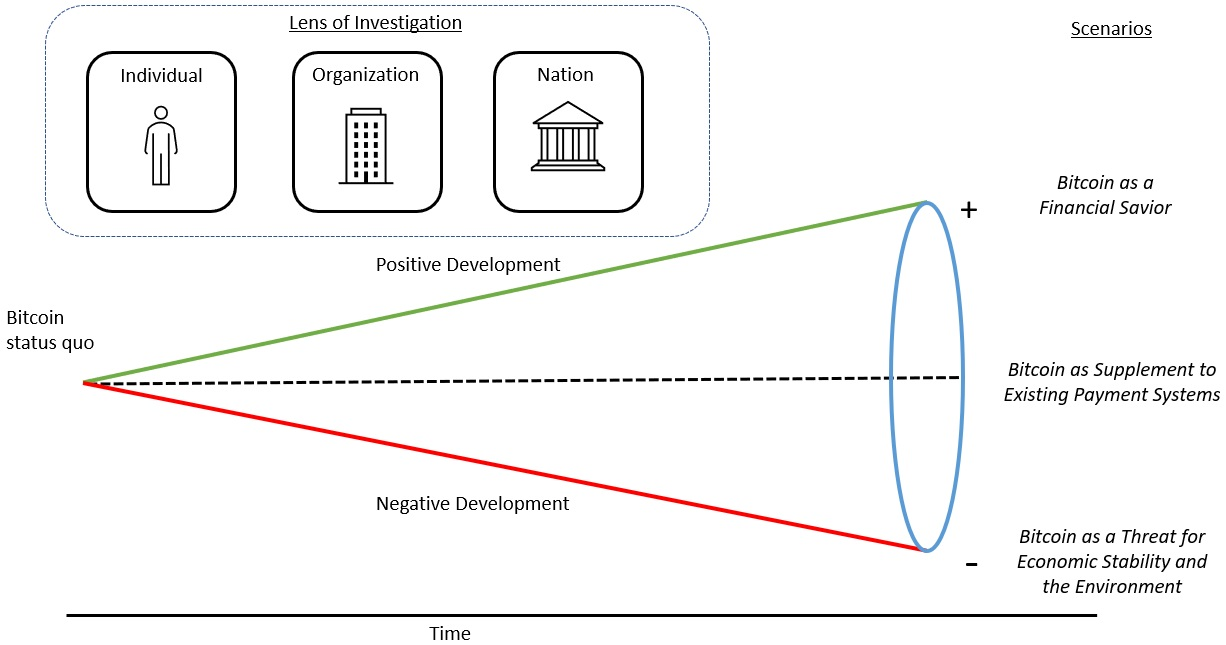

Looking ahead, the future of crypto lending looks promising. With the fundamentals of blockchain and cryptocurrencies, it is likely that digital assets will soon become the anchor point of the banking system. Once this shift occurs, the pricing and representation of assets will change, with the dollar and other traditional currencies taking a backseat.

At our company, we are at the forefront of this revolution. We understand the importance of staying ahead and adapting to the evolving financial landscape. Our team of experts is dedicated to providing the best lending solutions, ensuring that our clients can capitalize on the future of crypto lending.

The building blocks of Web3

Web3 refers to the next generation of the internet, where decentralized applications (DApps) are built on the blockchain, rather than on traditional databases. This new technology has the potential to revolutionize various industries, including finance and banking.

Blockchain technology provides a transparent and secure way for data and transactions to be recorded. In the context of financial services, it allows for the development of decentralized lending and borrowing applications. With Web3, individuals can lend and borrow money without the need for a traditional bank.

One of the key advantages of Web3 lending is the elimination of intermediaries. With traditional banking, borrowers have to go through numerous steps and pay fees to get a loan. But with Web3 lending platforms, borrowers and lenders can interact directly, eliminating the need for banks or other centralized institutions.

In addition to cutting out intermediaries, Web3 lending platforms also offer more competitive interest rates. With traditional banks, interest rates are often determined by the bank’s lending policies. But with Web3 lending, interest rates are determined by the supply and demand of lenders and borrowers on the platform. This can result in lower interest rates for borrowers and higher returns for lenders.

Web3 lending also opens up lending opportunities to a wider range of individuals and businesses. Traditional banks often have strict lending criteria, making it difficult for some borrowers to get approved for a loan. But with Web3 lending, borrowers can access capital from a global network of lenders who may be willing to provide loans based on different criteria.

Overall, the development of Web3 lending platforms is a significant catalyst for the future of lending and borrowing. With the rising popularity of cryptocurrencies and the decentralization of financial services, these platforms have the potential to disrupt the current banking system and provide individuals and businesses with more accessible and affordable lending options.

FAQ:

What is “The Future of Crypto Lending in the UK” about?

“The Future of Crypto Lending in the UK: Exploring Financial Trends and Catalysts” is a book that delves into the potential future of crypto lending in the UK. It discusses the current trends in the financial industry and explores the possible catalysts for the growth of crypto lending in the country.

Who is the author of “The Future of Crypto Lending in the UK”?

The author of “The Future of Crypto Lending in the UK: Exploring Financial Trends and Catalysts” is a renowned expert in the field of cryptocurrency and finance. They have conducted extensive research on the topic and have a deep understanding of the subject matter.

How can “The Future of Crypto Lending in the UK” benefit me?

“The Future of Crypto Lending in the UK: Exploring Financial Trends and Catalysts” can benefit you by providing valuable insights into the potential future of crypto lending in the UK. It can help you understand the current trends in the financial industry and identify the possible catalysts that can drive the growth of crypto lending. This knowledge can be beneficial for investors, financial institutions, and individuals interested in crypto lending.

Is “The Future of Crypto Lending in the UK” suitable for beginners?

Yes, “The Future of Crypto Lending in the UK: Exploring Financial Trends and Catalysts” is suitable for beginners. While it delves into the complex topic of crypto lending, it provides a comprehensive overview that can be easily understood even by those with limited knowledge of the subject. The book uses clear and concise language, making it accessible to readers at different levels of expertise.

What sets “The Future of Crypto Lending in the UK” apart from other books on the same topic?

“The Future of Crypto Lending in the UK: Exploring Financial Trends and Catalysts” stands out from other books on the same topic due to its in-depth analysis and comprehensive exploration of financial trends and catalysts. It goes beyond surface-level explanations and provides a nuanced understanding of the subject matter. The author’s expertise and extensive research also contribute to the book’s uniqueness.

Leave a Reply

You must be logged in to post a comment.