Small businesses in the UK are always on the lookout for faster, cheaper, and more transparent ways to access capital. With the advent of cryptocurrency and blockchain technology, these entrepreneurs now have a new means to achieve their financial goals.

Unlike traditional financial resources, crypto lending offers a decentralized network that operates on a blockchain. This means that there is no central authority controlling the flow of funds or imposing unnecessary fees. Instead, small businesses can borrow directly from a network of lenders, allowing for faster and cheaper access to the much-needed capital.

But what does this all mean for small business owners? It means that they can bypass the lengthy and costly authentication and valuation processes required by traditional financial institutions. Instead, they can access funds based on the worth of their digital assets, such as cryptocurrencies or other digital currencies. This not only saves them time, but also provides a more transparent and fair assessment of their business’s financial health.

Furthermore, the use of blockchain technology ensures that all transactions are recorded on a public ledger, making them more transparent and secure. Small businesses no longer need to rely on paper records or trust the financial statements provided by accountancy professionals. Instead, they can easily access and verify their financial records, creating a level of trust and ownership over their own payment obligations.

“The future of small business financing lies in cryptocurrency and blockchain technology,” said John Bianchini, a financial professional and expert in digital currencies. “Not only does it offer faster and cheaper access to capital, but it also provides small businesses with the means to truly take control of their financial future.”

Of course, like any new technology, there are disadvantages to consider. The volatility of cryptocurrencies can mean that the value of borrowed funds may fluctuate over time. Additionally, the relatively new nature of this technology means that there is still much to be learned about its implementation and potential risks.

However, for small businesses in the UK, the benefits of crypto lending far outweigh the disadvantages. Faster access to capital, cheaper transactions, and a more transparent financial system are just some of the reasons why entrepreneurs are turning to cryptocurrencies as a means to grow their businesses. The future of small business financing has arrived, and it’s powered by blockchain technology and cryptocurrency.

The Benefits of Crypto Lending for Small Businesses in the UK

Crypto lending provides small businesses in the UK with a faster and more transparent financial solution. Traditional lending processes can be time-consuming and require extensive paperwork, references, and accountancy valuations. However, with crypto lending, the need for these cumbersome processes is eliminated.

By using cryptocurrencies as collateral, small businesses can access funds more quickly and easily. The blockchain technology behind cryptocurrencies allows for faster authentication and verification, reducing the time it takes to evaluate a loan application. This means that small businesses can receive the funds they need to support their growth and investment plans much faster than through traditional financial institutions.

Another advantage of crypto lending is that it is often cheaper than traditional lending. Traditional banks and lending institutions often charge high interest rates and fees, which can be a burden for small businesses with limited financial resources. Crypto lending, on the other hand, can offer lower interest rates and fees, making it a more affordable option for small businesses.

Furthermore, crypto lending offers a more transparent and secure system compared to traditional lending. The use of blockchain technology ensures that all transactions are recorded and cannot be altered, providing a high level of security for both lenders and borrowers. This transparency helps to protect small businesses from fraud and provides a clear audit trail of all financial activities.

In conclusion, crypto lending offers small businesses in the UK a faster, cheaper, and more transparent financial solution. By using cryptocurrencies as collateral, small businesses can access funds more quickly and easily, cutting down on paperwork and accountancy valuations. Additionally, the use of blockchain technology provides a secure and transparent system that protects businesses from fraud. With these benefits, crypto lending is becoming an attractive option for small businesses looking for efficient and reliable financial services.

Faster, Cheaper, More Transparent: The Benefits of Crypto Lending for Small Businesses in the UK

Accessing capital for small businesses has always been a challenge. Traditional lending institutions often have lengthy approval processes and high interest rates, making it difficult for small businesses to secure the funds they need to grow. However, with the advent of crypto lending, things are changing.

One of the key advantages of crypto lending is its speed. Unlike traditional lending, where the approval process can take weeks or even months, crypto lending platforms can provide funds in a matter of hours. This allows small businesses to seize opportunities as they arise and execute their plans without delay.

Another significant advantage is the cost. Traditional lending usually comes with high interest rates and fees, which can eat into a business’s profits. Crypto lending, on the other hand, offers lower rates and fees, making it a more affordable option for small businesses. This allows them to allocate their financial resources more efficiently and invest in growth.

Moreover, crypto lending is more transparent compared to traditional lending. The use of blockchain technology ensures that all transactions and records are publicly available and can be verified by anyone. This transparency helps to protect against fraud and ensures that borrowers and lenders are held accountable. It also makes the valuation of collateral and the assessment of creditworthiness fairer and more accurate.

One of the key features of crypto lending is that it eliminates intermediaries, such as banks or financial institutions, from the lending process. This means that small businesses don’t have to rely on these intermediaries to approve or facilitate their loans. Instead, they can directly connect with lenders and access funds quickly and easily.

To sum up, crypto lending offers small businesses in the UK faster access to capital, cheaper borrowing costs, and a more transparent lending process. With the rise of digital currencies and blockchain technology, the future of lending looks bright for small businesses, allowing them to more effectively plan and invest in their growth.

What Does Cryptocurrency Mean?

Cryptocurrency is a digital or virtual form of currency that uses cryptography for secure transactions. It is a decentralized form of currency, which means it is not controlled by any government or central authority. The most popular and widely known cryptocurrency is Bitcoin, but there are many others, such as Ethereum, Litecoin, and Ripple.

Cryptocurrencies are created through a process called mining, which involves solving complex mathematical problems. Once created, they are stored in a digital wallet and can be used for various purposes, including online purchases, investments, and as a means of transferring money across borders.

The main advantages of using cryptocurrency include faster and cheaper transactions, greater security and privacy, and more transparent record-keeping. Cryptocurrency transactions are processed on a blockchain, which is a distributed ledger that records all transactions across a network of computers. This makes it virtually impossible for anyone to tamper with the transaction history or manipulate the system.

In addition, using cryptocurrency can also provide businesses with access to new sources of capital. They can raise funds by creating their own cryptocurrency or by participating in initial coin offerings (ICOs), which is similar to an initial public offering (IPO) in the traditional financial markets. This can be especially beneficial for small businesses, as it allows them to raise funds without going through traditional intermediaries, such as banks, which can be costly and time-consuming.

Disadvantages of Cryptocurrency

Despite the many benefits of cryptocurrency, there are also some disadvantages that businesses should be aware of. One of the main disadvantages is the volatility of cryptocurrency prices. The value of cryptocurrencies can fluctuate greatly, which means that businesses accepting cryptocurrency as payment may need to regularly adjust their prices or incur potential losses.

Another disadvantage is the lack of regulation and legal protection. Cryptocurrency transactions are not regulated by any government authority, which means that businesses and individuals may be at risk of fraud or theft. In addition, if a business loses access to its cryptocurrency wallet or if the wallet gets hacked, there is often no way to recover the lost funds.

Furthermore, while blockchain technology is touted as being more transparent and secure, it is still relatively new and may not be able to handle large volumes of transactions. This can result in slower transaction times and higher transaction fees.

Conclusion

In conclusion, cryptocurrency offers many advantages for businesses, such as faster and cheaper transactions, more transparent record-keeping, and access to new sources of capital. However, businesses should also be aware of the disadvantages, such as price volatility, lack of regulation, and potential security risks. Overall, using cryptocurrency can be a valuable tool for businesses, but it is important to weigh the potential benefits against the risks and make informed decisions.

Understanding the Concept and Implications

The concept of cryptocurrency and blockchain technology has revolutionized the way businesses operate. But what exactly does it mean and how does it work? In simple terms, cryptocurrency is a digital or virtual form of currency that uses cryptography for security. Blockchain, on the other hand, is a decentralized system that records transactions across multiple computers.

So, what does this mean for small businesses? Well, one of the biggest advantages is the transparency it offers. With blockchain technology, all transactions are recorded on a public ledger, which means that anyone can access and verify the information. This helps to protect the integrity of the system and ensure that all parties involved are accountable for their actions.

Another benefit is the speed and cost-effectiveness of cryptocurrency lending. Unlike traditional banking systems, which can take days or even weeks to process transactions, cryptocurrency lending can be done in a matter of minutes. This not only saves time but also reduces the costs associated with traditional banking services.

In addition, cryptocurrency lending can provide small businesses with access to capital that they may not have been able to obtain through traditional means. This can be particularly beneficial for entrepreneurs who may not have a long credit history or who may not meet the strict requirements of banks. Cryptocurrency lending allows them to secure loans based on the value of their digital assets, rather than relying solely on their creditworthiness.

Disadvantages of Using Cryptocurrency

While there are many benefits to using digital currencies, it is important to also consider the disadvantages that come with them. Here are some potential drawbacks of using cryptocurrency:

- Lack of Regulation: Cryptocurrencies operate outside of traditional financial systems and are not regulated by any central authority. This lack of regulation can make it difficult to protect against fraud or other illegal activities.

- Volatility: The value of cryptocurrencies can fluctuate greatly in a short period of time. This volatility makes them a risky investment and can lead to substantial losses.

- Limited Acceptance: While the number of businesses and merchants accepting cryptocurrencies is growing, it is still a relatively small percentage compared to traditional payment methods. This limits the usefulness of cryptocurrencies in everyday life.

- Complexity and Technical Knowledge: Using cryptocurrencies requires a certain level of technical understanding and knowledge. This can be a barrier for some people who are not familiar with the underlying technology.

- Limited Customer Support: Cryptocurrency services often have limited customer support options, which can make it difficult to resolve issues or get assistance when needed.

- Potential for Hacks and Scams: As cryptocurrencies exist solely in digital form, they are vulnerable to hacking and scams. This puts users at risk of losing their funds if proper security measures are not in place.

Considering these potential disadvantages, it is important for individuals and businesses to carefully evaluate the risks and benefits before using cryptocurrencies. While they offer some advantages, they may not be suitable for everyone or every situation. It is always recommended to do thorough research and seek professional advice when considering the use of cryptocurrencies.

Potential Risks and Drawbacks

While there are many benefits to crypto lending for small businesses, it is important to also consider the potential risks and drawbacks associated with this type of financing.

Increased Volatility

One of the main disadvantages of using cryptocurrencies for lending is their inherent volatility. Crypto assets such as Bitcoin or Ethereum can experience significant price fluctuations, which may impact the value of the collateral provided by borrowers. This volatility can make it difficult for lenders to accurately assess the risk of lending and may result in unexpected losses.

Lack of Regulation

Another concern with crypto lending is the lack of regulatory oversight. Unlike traditional financial institutions, the crypto market is largely unregulated, which means that there may be less protection for borrowers in case of disputes or fraudulent activities. In addition, the absence of clear regulations can make it harder to enforce loan agreements and recover collateral in the event of default.

Security Risks

While blockchain technology is generally considered secure, there have been instances of hacking and theft in the crypto space. Small businesses need to be aware of the potential security risks associated with crypto lending platforms and take steps to protect their digital assets. Implementing strong security measures and partnering with reputable platforms can help mitigate these risks.

Limited Acceptance and Infrastructure

Although cryptocurrencies are gaining more acceptance in the mainstream, they are still not widely accepted as a form of payment by businesses. This means that small businesses may face difficulties in finding vendors and suppliers who accept cryptocurrencies, potentially limiting their ability to use borrowed crypto funds for necessary expenses. Additionally, the infrastructure for crypto payments is still developing, which may result in delays or complications when using cryptocurrencies for transactions.

Technical Knowledge and Complexity

Using cryptocurrencies and crypto lending platforms requires a certain level of technical knowledge. Small business owners may need to invest time and effort into understanding the intricacies of the blockchain technology and how to securely manage their crypto assets. This additional complexity can be a barrier for those who are not familiar with the crypto space and may require professional assistance from accountants or financial advisors.

Uncertain Future

The cryptocurrency market is still relatively new and rapidly evolving. While there are opportunities for small businesses to leverage crypto lending for their financing needs, there is also a level of uncertainty regarding the future of cryptocurrencies and their long-term value. Fluctuations in the cryptocurrency market could potentially impact the repayment obligations of borrowers and the value of collateral held by lenders.

References:

- Bianchini, N. (2021). Cryptoasset Lending: Is it Worth Investing?

- OECD. (2020). The Taxation of Cryptocurrencies: An OECD Survey

- Paris, T. (2019). The Benefits and Risks of Cryptoasset Lending

Faster, Cheaper, More Transparent: The Benefits of Crypto Lending for Small Businesses in the UK

When it comes to lending and borrowing in the business world, speed, cost-effectiveness and transparency are key factors that can make or break a deal. With the advent of blockchain technology and cryptocurrency, small businesses in the UK now have access to a new and innovative way of obtaining the capital they need – faster, cheaper, and more transparent.

Faster

Traditional lending processes often involve lengthy paperwork, credit checks, and weeks of waiting. However, with crypto lending, entrepreneurs can benefit from a much faster process. By using blockchain technology, a secure and decentralized ledger, transactions can be conducted within minutes, eliminating the need for intermediaries and reducing processing time significantly.

Cheaper

The cost of borrowing funds can be a daunting aspect for small businesses. Traditional loans often come with high interest rates and additional fees. However, by utilizing cryptocurrencies for lending and borrowing, businesses can potentially save money. Cryptocurrency transactions are generally cheaper compared to traditional banking fees, and the absence of intermediaries further reduces costs.

More Transparent

Transparency is essential when it comes to financial transactions and borrowing. Blockchain technology provides an immutable and transparent record of all transactions made. This means that entrepreneurs can have a clear and auditable trail of their financial activities, making it easier for both businesses and lenders to assess creditworthiness and make informed decisions.

In conclusion, crypto lending offers small businesses in the UK the opportunity to obtain capital in a fast, cost-effective, and transparent manner. By leveraging blockchain technology and cryptocurrencies, entrepreneurs can bypass traditional intermediaries, eliminate paperwork, and gain access to a new and efficient lending system. The future of lending and borrowing lies in the power of blockchain, and small businesses should take advantage of the benefits it offers.

Why Small Businesses Should Consider Crypto Lending

Small businesses in the UK are increasingly turning to cryptocurrency lending as a faster, cheaper, and more transparent payment method. According to experts like Aaron Bianchini, the co-founder of a leading blockchain accountancy firm, using cryptocurrencies can significantly benefit businesses in various ways.

Faster and Cheaper: Cryptocurrencies enable instant transactions, eliminating the need for banks or third-party intermediaries. This allows businesses to receive payments faster, saving time and resources. Additionally, crypto transactions often come with lower fees compared to traditional banking systems.

More Transparent: The blockchain ledger, which underpins cryptocurrencies, provides a transparent record of all transactions. This transparency can help businesses build trust with their customers and partners, as it allows for easy verification of payment receipts and ensures the integrity of financial information.

Increased Valuation: By accepting cryptocurrencies, small businesses can tap into new markets and attract more customers. This can lead to an increase in the valuation of their business, as they harness the perceived value and potential of cryptocurrencies.

Access to Resources: Some businesses may face difficulties accessing loans or traditional financing from banks. Crypto lending platforms provide an alternative solution, allowing entrepreneurs to borrow funds by using their cryptocurrency holdings as collateral.

Protect Ownership: When small businesses opt for traditional financing, they often need to pledge collateral such as property or business assets. With crypto lending, businesses can protect their ownership and avoid the risk of losing their assets in case of default.

Future of Payment: As cryptocurrencies continue to gain popularity, it is important for businesses to stay ahead of the curve. Embracing crypto lending can position small businesses as innovative and forward-thinking brands, appealing to tech-savvy customers who prefer to use cryptocurrencies for transactions.

In conclusion, the benefits of crypto lending for small businesses in the UK are numerous. From faster and cheaper payments to increased transparency and access to resources, using cryptocurrencies can help businesses thrive in the digital age.

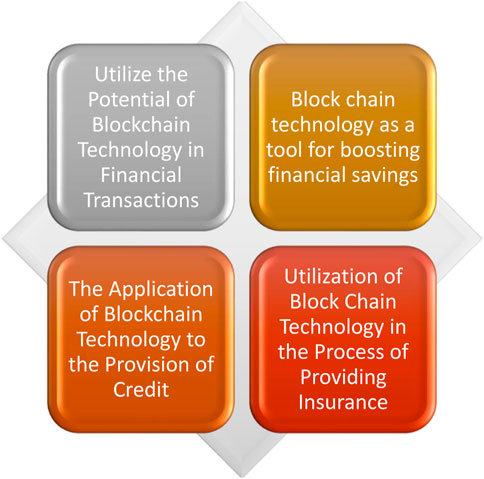

Blockchain and the Future of Accountancy

In today’s digital age, blockchain technology is revolutionizing various industries, and one of the areas that stand to benefit the most is accountancy. The advantages of blockchain for accountancy are numerous – faster, more transparent, and cost-effective.

One of the key benefits of blockchain for accountancy is the elimination of intermediaries. With traditional accounting methods, there are multiple intermediaries involved in the process, from banks to auditors. Blockchain technology allows for direct peer-to-peer transactions, cutting out the need for these intermediaries and reducing costs.

Furthermore, using blockchain technology in accountancy means that information is stored on a decentralized network, making it more secure and less prone to manipulation. This transparency also means that data can be easily accessed, making financial reporting more efficient and reducing the risk of errors.

Another advantage of blockchain for accountancy is the ability to conduct faster and cheaper audits. With blockchain, auditors can access real-time data and verify transactions instantly, reducing the time and cost associated with manual audits.

Blockchain technology in accountancy also opens up new possibilities for businesses to raise capital. With Initial Coin Offerings (ICOs), businesses can raise funds by selling digital tokens or coins to investors. This alternative method of fundraising allows entrepreneurs to access capital quickly and without the need for traditional financial institutions.

While there are definitely advantages to using blockchain in accountancy, there are also some disadvantages to consider. The technology is still relatively new and may not be fully understood or embraced by the profession. Additionally, there may be regulatory challenges and concerns regarding the use of digital currencies.

Overall, the future of accountancy looks promising with the integration of blockchain technology. Its ability to provide faster, cheaper, and more transparent financial services will benefit both businesses and individuals. As businesses continue to embrace this innovative technology, the role of accountants will evolve to ensure they can provide the necessary expertise in this new era of accounting.

The Revolutionary Impact on Financial Practices

The rise of cryptocurrencies has brought about a revolutionary impact on financial practices, offering a host of benefits for small businesses in the UK. One of the key advantages is access to faster and cheaper investment options, allowing entrepreneurs to grow their businesses at a quicker pace.

Unlike traditional financial systems, where accessing capital resources often involves a lengthy and expensive process, the use of cryptocurrencies allows for faster and more transparent transactions. This means that small businesses can receive the funds they need in a shorter amount of time, enabling them to seize opportunities and expand their operations.

Moreover, cryptocurrencies offer a higher level of security and authentication, protecting both the businesses and the people involved in the transactions. With traditional payment methods, there is always a risk of fraud or unauthorized access to financial information. However, through the use of cryptocurrencies, these risks are minimized, providing small businesses with greater peace of mind.

Another advantage of cryptocurrency lending is that it allows businesses to tap into a global network of investors. In the past, small businesses had limited options when it came to accessing investment capital. However, with the advent of cryptocurrencies, entrepreneurs can now attract investors from all over the world, expanding their potential funding sources.

Furthermore, the use of cryptocurrencies in financial practices not only allows for faster and cheaper access to capital, but also offers a more efficient way of managing finances. Accounting and bookkeeping, which are often time-consuming and require extensive resources, can be automated through the use of blockchain technology. This not only saves time and money, but also reduces the risk of human error.

In conclusion, the adoption of cryptocurrencies in financial practices has revolutionized the way small businesses operate. It offers faster, cheaper, and more transparent access to investment capital, while also providing enhanced security and authentication. With the future of finance leaning towards cryptocurrencies, small businesses in the UK would benefit greatly from embracing this new technology.

References

When it comes to the future of small businesses, cryptocurrency lending offers numerous advantages. By leveraging blockchain technology, small businesses can access faster and cheaper financial services.

One of the main benefits of crypto lending is the ability to obtain capital more quickly. Traditional financial institutions often have lengthy approval processes and require extensive paperwork. However, with crypto lending, businesses can receive funds within minutes or hours, allowing them to seize time-sensitive opportunities.

- Only a fraction of the cost: Utilizing cryptocurrencies for lending can significantly reduce transaction fees. Instead of dealing with intermediaries, businesses can directly connect with lenders, cutting out unnecessary costs. As a result, more capital can be allocated towards business growth and development.

- Greater transparency: The use of blockchain technology ensures a transparent system for recording and publishing financial transactions. This level of transparency enhances trust and confidence among lenders and borrowers, as all parties have access to the same verified information.

Furthermore, the decentralized nature of cryptocurrencies means that businesses can protect their financial resources from potential threats. Unlike traditional financial systems, which store data on centralized servers, cryptocurrencies utilize a distributed ledger called a blockchain. This makes it more difficult for hackers to manipulate the system and provides an added layer of security.

Cryptocurrency lending also offers benefits to small businesses by simplifying accounting and financial planning processes. By using cryptocurrencies, businesses can automate and authenticate financial transactions, reducing the need for manual record-keeping and potential human error.

- OECD papers: The Organization for Economic Co-operation and Development (OECD) has published papers highlighting the potential of cryptocurrencies to revolutionize the financial industry. These papers emphasize the benefits of increased transparency, faster transactions, and reduced costs.

- Profession of accountancy: The accountancy profession is also recognizing the future potential of cryptocurrencies. The Financial Reporting Council (FRC) in the UK has stated that the profession needs to adapt to the emergence of cryptocurrencies and blockchain technology to stay relevant in a digital age.

In conclusion, the use of cryptocurrencies for lending purposes can bring numerous advantages to small businesses. By providing faster and cheaper financial services, cryptocurrencies enable businesses to access capital more quickly. Additionally, the use of blockchain technology ensures greater transparency and security in financial transactions. With the benefits of cryptocurrencies becoming increasingly recognized, small businesses will be eager to embrace this innovative financial solution.

Вопрос-ответ:

What is crypto lending?

Crypto lending is a process where individuals or businesses lend cryptocurrencies to others in return for interest payments. It allows borrowers to access funds without the need for traditional financial intermediaries like banks.

How does crypto lending benefit small businesses in the UK?

Crypto lending provides several benefits for small businesses in the UK. First, it is faster compared to traditional lending methods as there are no lengthy application processes or credit checks. Second, it is cheaper as interest rates are often lower compared to traditional loans. Third, it offers more transparency as blockchain technology ensures all transactions are recorded and can be audited. Overall, crypto lending provides small businesses in the UK with a more efficient and cost-effective way to access funds.

Is crypto lending safe for small businesses?

Yes, crypto lending can be safe for small businesses if they take necessary precautions. It is important to choose reputable lending platforms and conduct thorough research before participating in any lending activities. Small businesses should also be cautious of the volatility of cryptocurrencies and be prepared for potential price fluctuations. Additionally, implementing strong security measures, such as using hardware wallets and multi-factor authentication, can further enhance the security of crypto lending transactions.

Can small businesses in the UK use crypto loans for any purpose?

Yes, small businesses in the UK can use crypto loans for various purposes. They can use the funds to expand their operations, invest in new equipment or technology, hire additional staff, or even settle existing debts. Crypto loans provide flexibility and can be used for any business-related expenses, allowing small businesses to meet their specific financial needs.

What are the tax implications of crypto lending for small businesses in the UK?

The tax implications of crypto lending for small businesses in the UK can vary depending on several factors. Income derived from crypto lending is generally subject to income tax. Small businesses may also need to consider other tax obligations, such as capital gains tax, if they sell the cryptocurrencies received as loan repayments. It is recommended for small businesses to consult with a tax professional to ensure compliance with the relevant tax regulations and to effectively manage their tax liabilities.

Видео:

This Is How You Can Buy Real Estate With Little or No Money – Robert Kiyosaki

This Is How You Can Buy Real Estate With Little or No Money – Robert Kiyosaki by InvestoPads 2 years ago 22 minutes 4,753,333 views

How to Get Crypto Loan on Binance FAST & EASY = FLEXIBLE Crypto Loans

How to Get Crypto Loan on Binance FAST & EASY = FLEXIBLE Crypto Loans by Learn to Make Honest Money Online 4 weeks ago 8 minutes, 24 seconds 1,939 views

Crypto Regulation INCOMING!! What The UK is Planning!

Crypto Regulation INCOMING!! What The UK is Planning! by Coin Bureau 4 months ago 22 minutes 134,501 views

584: Binance Reg Cancelled, Crypto Volatility, Defamation Lawsuit, Hinman Impact, French Reg Support

584: Binance Reg Cancelled, Crypto Volatility, Defamation Lawsuit, Hinman Impact, French Reg Support by The Crypto Overnighter Podcast🎙️ 6 days ago 16 minutes 29 views

Best Personal Loans England 🇬🇧 | Top 10 Personal Secured Loan UK – England Personal Loan Companies

Best Personal Loans England 🇬🇧 | Top 10 Personal Secured Loan UK – England Personal Loan Companies by Business Snap 1 year ago 8 minutes, 12 seconds 13,290 views

✅ GET A CRYPTO LOAN WITH BYBIT (SUPER CHEAP & EASY!!!) BORROW BITCOIN, CRYPTO & ALTCOINS!!

✅ GET A CRYPTO LOAN WITH BYBIT (SUPER CHEAP & EASY!!!) BORROW BITCOIN, CRYPTO & ALTCOINS!! by Marzell Trading 6 months ago 12 minutes, 20 seconds 3,879 views

Buyer Beware! Is Temu Legit And Safe To Buy From? (My Unbiased Review)

Buyer Beware! Is Temu Legit And Safe To Buy From? (My Unbiased Review) by MyWifeQuitHerJob Ecommerce Channel 2 months ago 12 minutes, 1 second 555,404 views

Earn passive income with Kucoin Crypto Lending: Complete Guide For Beginners

Earn passive income with Kucoin Crypto Lending: Complete Guide For Beginners by Mr. Money 1 year ago 10 minutes, 16 seconds 11,742 views

The Future Of DeFi Lending? Undercollateralized Loans Explained!

The Future Of DeFi Lending? Undercollateralized Loans Explained! by CoinGecko 1 year ago 8 minutes, 59 seconds 4,334 views

“NEVER Invest in These 7 Types Of Real Estate Properties in 2021!” – Robert Kiyosaki

“NEVER Invest in These 7 Types Of Real Estate Properties in 2021!” – Robert Kiyosaki by InvestoPads 2 years ago 9 minutes, 43 seconds 1,170,192 views

Crypto Borrowing Strategy – Tactic #01 as a KEY to Maximizing your Earning Potential on DeFi Borrows

Crypto Borrowing Strategy – Tactic #01 as a KEY to Maximizing your Earning Potential on DeFi Borrows by The DeFi Whale 1 year ago 6 minutes, 59 seconds 6,218 views

Top 5 BEST Crypto Exchanges in 2023: Are They SAFE?!

Top 5 BEST Crypto Exchanges in 2023: Are They SAFE?! by Coin Bureau 4 months ago 31 minutes 217,784 views

Bybit Lending Review: How to Make Money on Bybit (Bonus $30,000)

Bybit Lending Review: How to Make Money on Bybit (Bonus $30,000) by Learn to Make Honest Money Online 4 weeks ago 10 minutes, 33 seconds 1,186 views

“I Was $800,000 in Bad DEBT” | Robert Kiyosaki | How To Pay Back Your Debt Fast

“I Was $800,000 in Bad DEBT” | Robert Kiyosaki | How To Pay Back Your Debt Fast by Be Awakened 2 years ago 13 minutes, 31 seconds 715,151 views

Hundreds of BlackRock and KKR Owned Businesses Face BANKRUPTCY Risk as Leveraged Loan Yields SOAR

Hundreds of BlackRock and KKR Owned Businesses Face BANKRUPTCY Risk as Leveraged Loan Yields SOAR by RJ Talks 5 days ago 9 minutes, 15 seconds 156,518 views

What is Crypto Lending? [ Explained With Animations ]

What is Crypto Lending? [ Explained With Animations ] by CoinMarketCap 11 months ago 5 minutes, 47 seconds 8,067 views

How to invest in Crypto (UK) Full Beginners Guide 2023

How to invest in Crypto (UK) Full Beginners Guide 2023 by Nick JM 1 year ago 21 minutes 39,118 views

Crypto Lending 2023 – THE DEFINITIVE GUIDE by CoinMarketCap

Crypto Lending 2023 – THE DEFINITIVE GUIDE by CoinMarketCap by CoinMarketCap 1 year ago 7 minutes, 12 seconds 23,777 views

HOW TO LOAN YOUSELF MONEY IN MINUTES WITH THIS TRICK!

HOW TO LOAN YOUSELF MONEY IN MINUTES WITH THIS TRICK! by Its Super Dave 1 year ago 10 minutes, 41 seconds 72,702 views

Top Crypto Lending Platforms | What Are The Best Crypto Lending Platforms

Top Crypto Lending Platforms | What Are The Best Crypto Lending Platforms by kafy Crypto 7 months ago 5 minutes, 43 seconds 141 views

How To Earn FREE 1000 USDT In Trust Wallet (NO INVESTMENT)

How To Earn FREE 1000 USDT In Trust Wallet (NO INVESTMENT) by Proffteqs 1 year ago 4 minutes, 40 seconds 809,819 views

This Is How You Can Buy Real Estate With Little or No Money – Robert Kiyosaki

This Is How You Can Buy Real Estate With Little or No Money – Robert Kiyosaki by InvestoPads 2 years ago 22 minutes 4,753,333 views

Leave a Reply

You must be logged in to post a comment.