When it comes to selling or lending your money, many people are starting to become more interested in the world of cryptocurrencies. With the increasing adoption and popularity of cryptoassets, it’s important to understand the differences between crypto loans and traditional loans in order to make an informed decision.

One of the key differences is the approach to security. Traditional loans are typically backed by physical assets or collateral, such as a house or car. This provides a level of stability and reassurance for lenders, as they have something tangible to rely on if the borrower defaults on their payments.

On the other hand, crypto loans are based on the use of cryptocurrencies as collateral. This introduces a new level of volatility, as the value of cryptoassets can fluctuate greatly. However, this type of lending has its own advantages, such as the ability to lend without the need for a traditional banking sector.

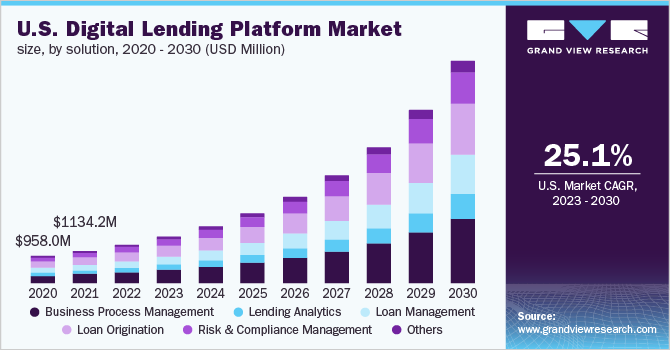

For those who are willing to take on the associated risks, crypto loans can provide a higher margin for potential gains. The implications of this are still being studied, but it is clear that the crypto lending sector is growing rapidly.

So, how do crypto loans compare to traditional loans in terms of security? It all depends on your risk tolerance and the stability you are looking for. While traditional loans may offer more stability, crypto loans offer the potential for higher returns.

It’s also worth noting that the lending market for cryptoassets is still relatively new and not as mature as the traditional lending market. This means that there may be some uncertainties and risks associated with this type of lending.

In conclusion, crypto loans and traditional loans each have their own benefits and drawbacks. Whether you choose to lend through a traditional or a cryptoasset-based platform, it’s important to do your own research and understand the implications and risks involved.

sources: binance.com, worldwidecoindaily.com

How do crypto loans work?

With the rapid growth of the crypto sector, those who hold cryptoassets are looking for ways to make use of their investments. Traditional loans are usually associated with banks and require extensive paperwork and credit checks. However, crypto loans provide a new approach to lending and borrowing money by leveraging the potential of cryptocurrency.

When you take out a crypto loan, you can use your crypto assets as collateral. This means that you don’t have to sell your crypto, allowing you to maintain your investment and benefit from any potential gains in the market. The crypto assets you use as collateral are stored securely in a digital wallet until you repay the loan.

One of the key benefits of crypto loans is the flexibility they offer. Crypto loans are available worldwide and can be used for any purpose, whether it’s to invest in more crypto, take advantage of margin lending, or simply get cash to spend. The amount you can borrow is based on the value of the crypto you provide as collateral.

Another important aspect of crypto loans is the associated interest rates. Due to the volatility of the crypto markets, interest rates for crypto loans tend to be higher compared to traditional loans. However, with the increasing adoption of decentralized finance (DeFi), there are now more options available for those looking to borrow or lend crypto.

Overall, crypto loans offer a unique opportunity for individuals to access liquidity without selling their cryptoassets. Whether you are a crypto enthusiast or simply looking for alternative financial options, crypto loans provide a viable solution with potential benefits and implications in the banking sector.

Why do people take out crypto loans?

There are many reasons why people choose to take out crypto loans. One of the most commonly used reasons is to access cash without selling their cryptoassets. When the value of their crypto increases, they can take advantage of the gains by borrowing against their holdings instead of selling them. This not only allows them to keep their crypto investments and potential future gains, but also provides them with immediate liquidity.

Another reason why people opt for crypto loans is because traditional banking systems may not be able to offer the same level of flexibility and speed. In the fast-paced world of crypto markets, where prices can fluctuate rapidly, traditional loans may not be able to keep up. Crypto loans, on the other hand, can be processed quickly and funds can be made available almost instantly.

It’s also important to consider the potential implications of taking out a crypto loan. While the crypto sector has seen significant adoption and growth, it is still a relatively new and evolving industry. There may be risks associated with borrowing against cryptoassets, such as market volatility and regulatory changes.

For those who understand how crypto loans work and are comfortable with the associated risks, taking out a loan can provide an opportunity to increase their financial position. By leveraging their crypto holdings, they can access a larger amount of money than what would be available through traditional loans or by selling their cryptoassets.

So, whether you’re looking for quick cash, want to retain ownership of your crypto investments, or are simply interested in exploring the world of crypto lending, taking out a crypto loan can provide you with a flexible and potentially lucrative financial option.

Financial stability implications of cryptoassets and associated markets

In recent years, there has been a significant increase in the worldwide adoption of cryptocurrencies and the associated markets. Many people are now opting for crypto loans instead of traditional loans from traditional banking institutions. But why are they choosing this approach and what are the financial stability implications?

One important factor is the volatility of cryptoassets compared to traditional financial markets. Crypto markets are known to be much more volatile, meaning that the value of cryptocurrencies can fluctuate greatly in a short period of time. However, this volatility also presents an opportunity for those who are willing to take on the risk.

For example, lending platforms like Binance offer the opportunity to earn interest by lending out your crypto. This is a type of margin lending, where you lend your cryptocurrency to other traders who want to trade on margin. In return, you’ll receive interest on your loan, which can often be higher than traditional banking interest rates.

But before jumping into crypto loans, it’s important to understand the risks associated with them. Unlike traditional loans, crypto loans are not backed by any physical asset or government guarantee. This means that if the borrower defaults on their loan, there may not be any recourse for the lender to recoup their funds.

Furthermore, the lack of regulation in the crypto sector makes it difficult to ascertain the credibility and reliability of lending platforms. It’s important to do thorough research and gather as much information as possible before deciding to lend your crypto.

Overall, while crypto loans may present an opportunity to earn higher returns, they also come with increased risks compared to traditional loans. It’s important to weigh these factors carefully and take a cautious approach when entering the crypto lending market.

What Is Crypto Lending

Crypto lending is a relatively new concept in the financial sector that allows individuals and businesses to borrow and lend cryptocurrencies instead of traditional currencies. It offers unique advantages and opportunities for both borrowers and lenders.

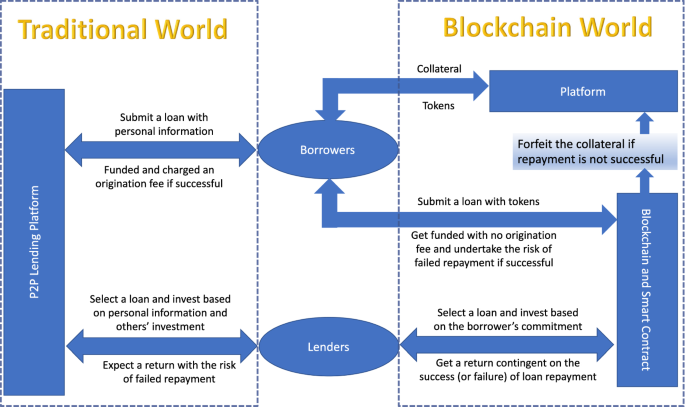

When you opt for crypto loans, you’ll be able to access funds quickly and conveniently. You can choose from a variety of lending platforms and select the one that best suits your needs. These platforms connect borrowers and lenders through smart contracts, ensuring a secure and transparent process.

One of the key benefits of crypto lending is the ability to earn interest on your assets. By lending your cryptocurrencies to others, you can earn passive income through the interest payments. This can be especially beneficial in a volatile market, as it allows you to potentially earn higher returns compared to traditional banking options.

Another important aspect of crypto lending is the stability it offers. Unlike traditional lending, where the loan value is dependent on the borrower’s creditworthiness, crypto loans are secured by crypto assets. This means that even if the borrower defaults on the loan, the lender can sell the crypto collateral to recover the loan amount.

If you’re looking to borrow, crypto loans can offer more flexibility and options compared to traditional loans. You can borrow any amount without restrictions, and you have the freedom to use the loaned funds for any purpose, whether it’s to start a business, invest in new ventures, or simply cover personal expenses.

Overall, crypto lending has gained popularity due to its innovative approach and the potential it offers. By avoiding traditional financial institutions and embracing the crypto market, you can take advantage of the growing adoption of cryptocurrencies and the worldwide interest in crypto loans.

So, whether you’re a borrower or a lender, there are many reasons to consider crypto lending. It provides a secure and transparent way to access funds or earn interest on your assets, all while taking advantage of the benefits of cryptocurrencies and avoiding the potential volatility and limitations of traditional banking.

FAQ

What is a crypto loan?

A crypto loan is a type of loan that allows borrowers to use their cryptocurrency holdings as collateral. It is a form of lending that is conducted using digital assets like Bitcoin, Ethereum, or other cryptocurrencies.

How do crypto loans work?

Crypto loans work by allowing borrowers to deposit their cryptocurrency holdings into a smart contract or platform. The value of the deposited assets is then used as collateral to secure the loan. Borrowers can receive a specified amount of traditional currency in exchange for their crypto assets. The loan is usually repaid with interest over a predetermined period of time.

What are the benefits of crypto loans compared to traditional loans?

Crypto loans offer several benefits compared to traditional loans. Firstly, crypto loans can provide faster access to funds, as there is no need for extensive paperwork or credit checks. Additionally, borrowers can avoid the hassle of selling their crypto assets, as they can be used as collateral. Crypto loans also have the potential for lower interest rates and more flexible terms compared to traditional loans.

Are crypto loans safe?

Crypto loans can be considered relatively safe, as they use blockchain technology to secure transactions and collateral. However, there are still risks involved, such as price volatility of cryptocurrencies and potential hacking or fraud in the crypto lending platforms. It is important for borrowers to carefully research and choose reputable platforms for crypto loans.

What happens if the price of the cryptocurrency used as collateral drops?

If the price of the cryptocurrency used as collateral drops, borrowers may be required to provide additional collateral to maintain the loan-to-value ratio. If borrowers are unable to provide additional collateral, lenders may have the right to liquidate the collateral to recover the loan amount. It is important for borrowers to closely monitor the value of their collateral and take necessary actions to avoid liquidation.

Are there any legal regulations for crypto loans in Britain?

Currently, the regulatory framework for crypto loans in Britain is still in development. The Financial Conduct Authority (FCA) has issued guidelines for crypto assets, but specific regulations for crypto loans are not yet in place. It is recommended for borrowers to seek legal advice and choose platforms that comply with existing regulations to ensure the security of their transactions.

Can I use any type of cryptocurrency as collateral for a crypto loan?

Most crypto lending platforms accept popular cryptocurrencies like Bitcoin and Ethereum as collateral. However, the acceptance of specific cryptocurrencies may vary between platforms. It is important to check with the platform you are interested in to see which cryptocurrencies they accept as collateral.

VIDEO

Comparing Crypto Backed Loans | Celsius, Crypto.com, Nexo, and Blockfi

Comparing Crypto Backed Loans | Celsius, Crypto.com, Nexo, and Blockfi by Project Influencers 2 years ago 12 minutes, 28 seconds 1,575 views

Crypto loans on Guarda Wallet

Crypto loans on Guarda Wallet by Guarda Wallet 2 years ago 1 minute, 13 seconds 1,427 views

Crypto Loan Platforms To Watch | 90% Compared To Celsius + Nexo

Crypto Loan Platforms To Watch | 90% Compared To Celsius + Nexo by Paul Barron Network 1 year ago 41 minutes 27,829 views

What is Crypto Lending? [ Explained With Animations ]

What is Crypto Lending? [ Explained With Animations ] by CoinMarketCap 11 months ago 5 minutes, 47 seconds 8,067 views

What Are Crypto Loans? Is Crypto Loans Without Collateral Possible?

What Are Crypto Loans? Is Crypto Loans Without Collateral Possible? by CoinGecko 1 year ago 7 minutes, 11 seconds 8,201 views

*The Netherlands Is The Worst Country in Europe. Here’s Why

*The Netherlands Is The Worst Country in Europe. Here’s Why by Josefa Vlogs 3 years ago 6 minutes, 6 seconds 1,064,121 views

3 Reasons You Shouldn’t Move to Dubai (Truth)

3 Reasons You Shouldn’t Move to Dubai (Truth) by Wealthy Expat 7 months ago 4 minutes, 57 seconds 250,912 views

Best Personal Loans England 🇬🇧 | Top 10 Personal Secured Loan UK – England Personal Loan Companies

Best Personal Loans England 🇬🇧 | Top 10 Personal Secured Loan UK – England Personal Loan Companies by Business Snap 1 year ago 8 minutes, 12 seconds 13,290 views

Top 5 BEST Crypto Exchanges in 2023: Are They SAFE?!

Top 5 BEST Crypto Exchanges in 2023: Are They SAFE?! by Coin Bureau 4 months ago 31 minutes 217,784 views

BEST Crypto Lending Platforms: TOP 5 Picks!! 💸

BEST Crypto Lending Platforms: TOP 5 Picks!! 💸 by Coin Bureau 2 years ago 23 minutes 141,412 views

Britain’s Mortgage Crisis!

Britain’s Mortgage Crisis! by Patrick Boyle 2 days ago 24 minutes 220,421 views

Difference between Secured vs. Unsecured loans | Banking Products | HSBC UK

Difference between Secured vs. Unsecured loans | Banking Products | HSBC UK by HSBC UK 2 years ago 38 seconds 960 views

Why Crypto Lending’s Risks May Spark a Serious Regulator Crackdown

Why Crypto Lending’s Risks May Spark a Serious Regulator Crackdown by Dion Rabouin | WSJ 1 year ago 7 minutes, 50 seconds 13,336 views

5 Crypto Lending Platforms Compared!!

5 Crypto Lending Platforms Compared!! by Coin Bureau 2 years ago 22 minutes 190,090 views

What are the BEST Crypto Loan Platforms? (For Lenders & Borrowers)

What are the BEST Crypto Loan Platforms? (For Lenders & Borrowers) by Crypto Current 1 year ago 10 minutes, 39 seconds 2,055 views

Crypto Lending 2023 – THE DEFINITIVE GUIDE by CoinMarketCap

Crypto Lending 2023 – THE DEFINITIVE GUIDE by CoinMarketCap by CoinMarketCap 1 year ago 7 minutes, 12 seconds 23,777 views

Five good reasons to use crypto loans instead of traditional bank loans

Five good reasons to use crypto loans instead of traditional bank loans by Marnotaur | Margin Trading 1 year ago 5 minutes, 48 seconds 1,228 views

What are crypto loan ? and it’s risk ? Lets Compare Binance VS Gate.io

What are crypto loan ? and it’s risk ? Lets Compare Binance VS Gate.io by Decentral Nation 08 8 months ago 26 minutes 5,140 views

Best Crypto Lending – BlockFi vs Celsius Network – Crypto Backed Loans 2020

Best Crypto Lending – BlockFi vs Celsius Network – Crypto Backed Loans 2020 by Aaron Bennett 2 years ago 20 minutes 6,048 views

Secured Vs Unsecured Lending (don’t make this mistake!)

Secured Vs Unsecured Lending (don’t make this mistake!) by Jeff Sekinger 3 years ago 8 minutes, 53 seconds 21,171 views

The real reason BANKS are BLOCKING CRYPTO exchanges.

The real reason BANKS are BLOCKING CRYPTO exchanges. by Damien Talks Money 1 year ago 10 minutes, 43 seconds 72,689 views

Crypto-Backed Loans Are a BAD Idea (Here’s Why)

Crypto-Backed Loans Are a BAD Idea (Here’s Why) by projectfinance 11 months ago 9 minutes, 14 seconds 4,664 views

Crypto Loan without Collateral vs BINANCE LOANS (Flash Loans Crypto)

Crypto Loan without Collateral vs BINANCE LOANS (Flash Loans Crypto) by Learn to Make Honest Money Online 9 months ago 13 minutes, 12 seconds 10,586 views

Why & How to take a CRYPTO Loan – with Matrixport

Why & How to take a CRYPTO Loan – with Matrixport by Tony D | The Chief Finance Officer 1 year ago 5 minutes, 5 seconds 1,612 views

Comparing Crypto Backed Loans | Celsius, Crypto.com, Nexo, and Blockfi

Comparing Crypto Backed Loans | Celsius, Crypto.com, Nexo, and Blockfi by Project Influencers 2 years ago 12 minutes, 28 seconds 1,575 views

Leave a Reply

You must be logged in to post a comment.