In the dynamic and ever-evolving landscape of the cryptocurrency market, there emerge innovative opportunities that allow you to not only participate actively but also maximize the potential of your holdings. One such avenue that has gained significant traction is the realm of crypto lending platforms. These platforms offer a unique and ingenious means to earn interest on your digital assets while retaining full ownership of them. In this comprehensive discourse, we will delve deep into the world of crypto lending platforms, exploring six prominent platforms that have made a mark in the landscape. Each of these platforms boasts its unique features, advantages, and limitations, providing a wealth of options for those looking to venture into the exciting realm of crypto lending.

Understanding the Essence of Crypto Lending Platforms: In the intricate world of cryptocurrencies, lending platforms have emerged as a revolutionary concept, offering a dual pathway for cryptocurrency enthusiasts to harness the potential of their digital assets. These platforms introduce a novel way to both earn passive income and gain access to liquidity without the need to liquidate your cherished digital holdings. The mechanics of these platforms encompass a dual nature, catering to both lenders and borrowers, and are intricately tied to the concept of leveraging your crypto assets. Let’s unpack the dynamics underlying these platforms.

Earning Passive Income and Acquiring Funds

- Passive Income Generation: For those who possess cryptocurrencies and seek avenues to generate passive income, the option to deposit these assets into decentralized lending platforms presents itself. This action effectively transitions you into the role of a lender. Your crypto holdings are made available to other users in need, and in return, you stand to earn a steady stream of interest on your deposits.

- Borrowing Funds: Conversely, if you find yourself in need of funds but are hesitant to part with your valuable cryptocurrencies, crypto lending platforms offer a compelling solution. By using your cryptocurrencies as collateral, you can secure loans in the form of stablecoins, cryptocurrencies that are pegged to the value of traditional assets. This mechanism empowers you to access much-needed liquidity without relinquishing ownership of your digital assets.

Unveiling the Operational Mechanics of Crypto Lending Platforms: At the core of these platforms lies blockchain technology, the very foundation of the cryptocurrency ecosystem. However, the true magic emerges through the utilization of smart contracts, which are self-executing contracts wherein the terms are directly coded into the blockchain. These smart contracts intricately govern all facets of lending operations, from the determination of interest rates to the eventual release of collateral upon successful loan repayment. This decentralized approach fundamentally eliminates the requirement for traditional intermediaries, banks, or lending institutions.

Top Crypto Lending Platforms of 2023:

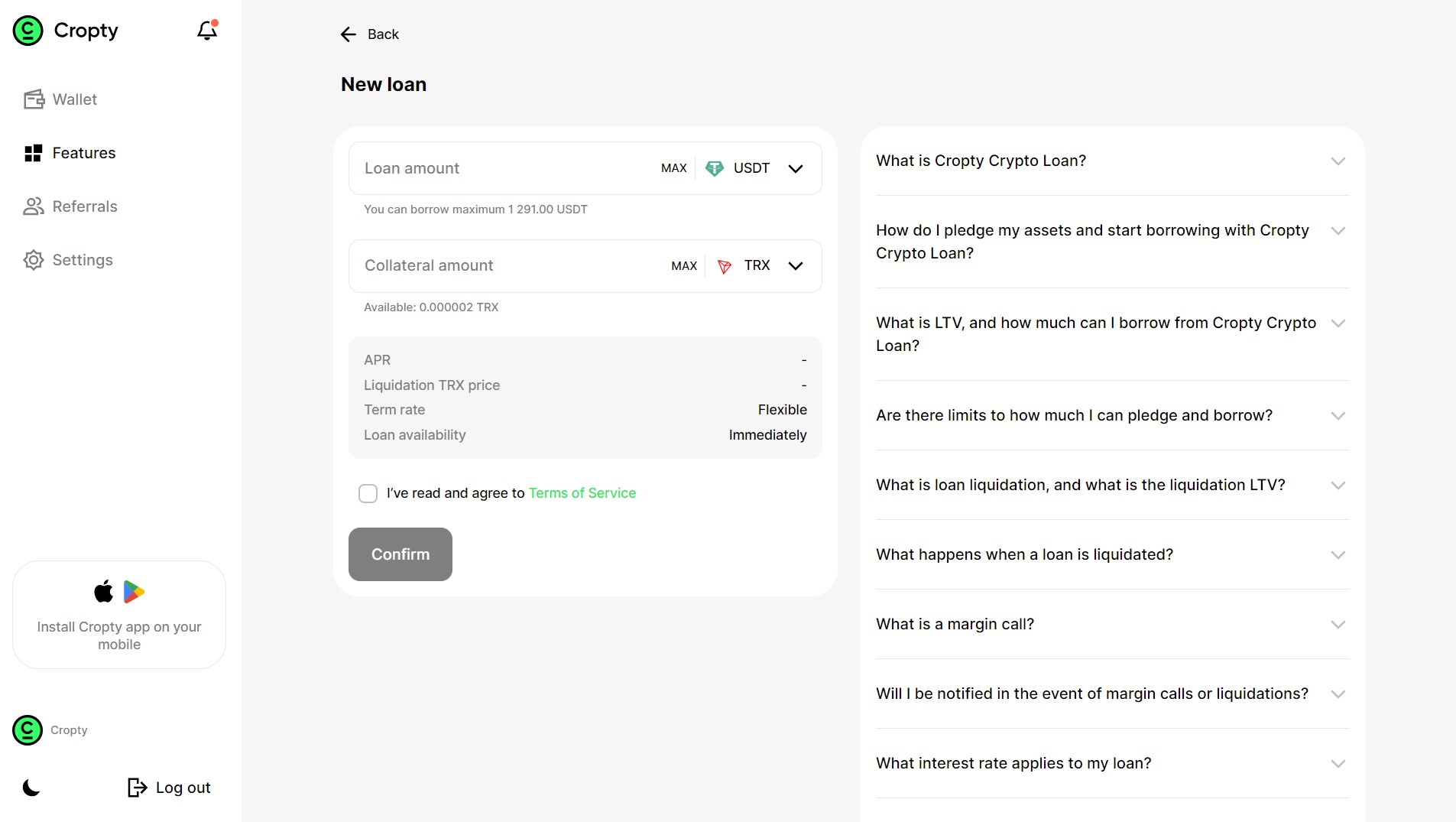

Cropty Wallet:

Description: Cropty Wallet emerges as a secure and adaptable crypto lending platform that presents a distinctive offering of overcollateralized loans. Users have the opportunity to pledge their crypto assets as collateral, thereby securing loans while sidestepping concerns of rehypothecation.

Advantages:

- Secure and flexible loan products cater to diverse user needs.

- Overcollateralized loans provide an added layer of risk reduction.

- Crypto assets remain within user possession, eliminating lending to third parties.

Limitations:

- Notable limitation lies in the relatively confined range of supported cryptocurrencies.

Binance Earn:

Description: Binance Earn represents a natural extension of the popular Binance exchange, presenting users with an avenue to engage in crypto lending activities. The platform presents the opportunity to earn interest through lending activities, predominantly catering to margin traders.

Advantages:

- Seamless integration with one of the largest and most reputable crypto exchanges.

- Wide array of supported cryptocurrencies, enhancing diversification opportunities.

- Duality in lending options, encompassing both fixed and flexible approaches.

Limitations:

- Some opportunities and events with higher interest rates may have a limited and time-sensitive nature.

BlockFi:

Description: BlockFi emerges as a leading lending platform that extends interest on an assortment of cryptocurrencies, including stalwarts such as Bitcoin and Ethereum, as well as stablecoins. Renowned for its competitive interest rates, the platform also prides itself on its user-friendly interface.

Advantages:

- Competitive interest rates provide an attractive proposition for potential lenders.

- User-friendly platform design ensures a seamless and accessible experience.

- Wide-ranging support for a diverse set of cryptocurrencies.

Limitations:

- Interest rates may exhibit variance based on the quantum of supplied crypto assets.

- Notably less decentralized compared to other platforms in the landscape.

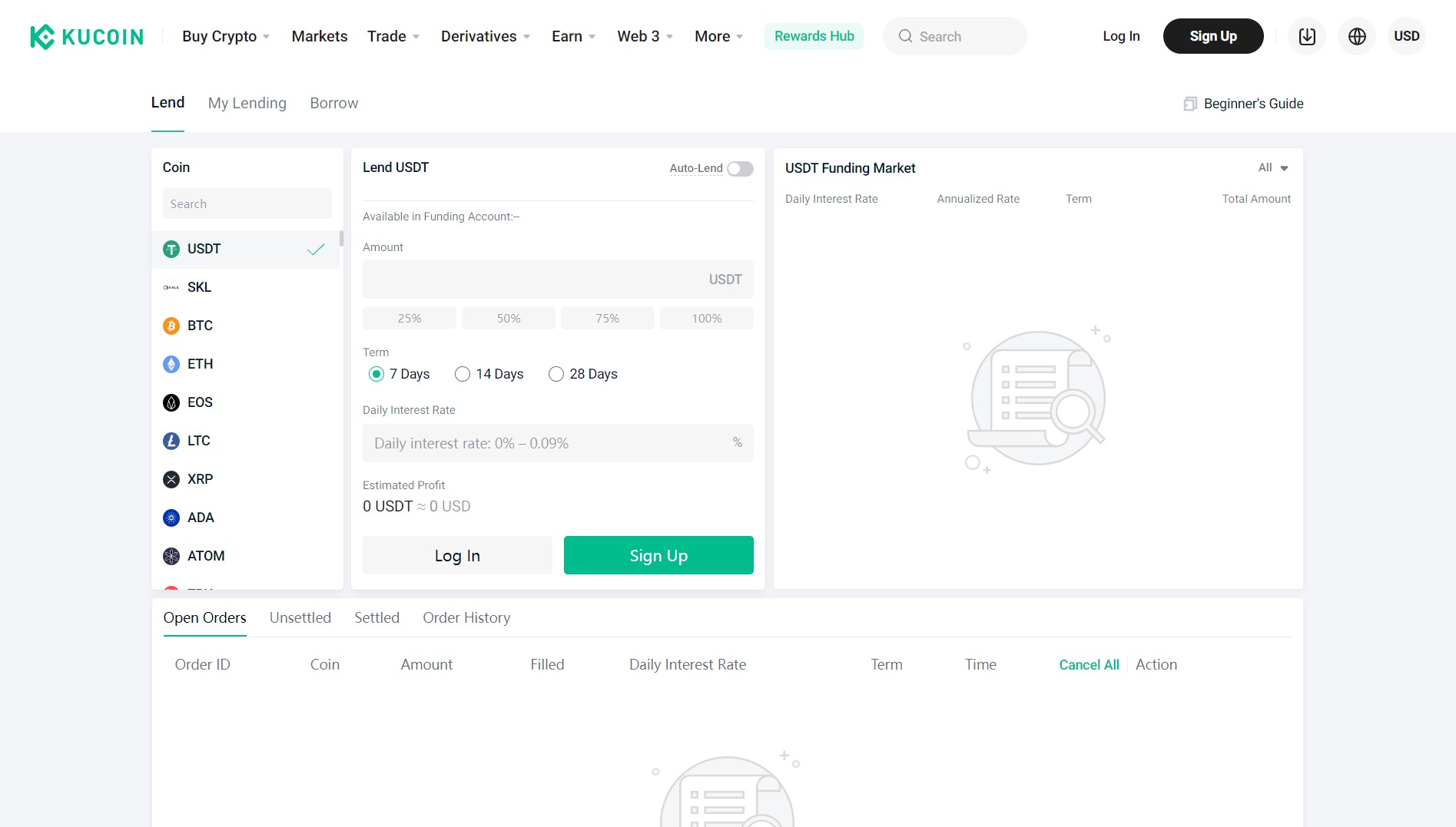

KuCoin Lending:

Description: KuCoin Lending emerges as an extension of the well-established KuCoin exchange, presenting an array of lending options for various cryptocurrencies. The platform particularly emphasizes fixed-term lending for popular cryptocurrencies and stablecoins.

Advantages:

- Integration with a reputable exchange instills a sense of confidence among users.

- Competitive interest rates make lending an appealing proposition.

- Fixed-term lending options cater to users seeking structured returns.

Limitations:

- Availability of flexible lending options is relatively limited.

- The repertoire of available cryptocurrencies for lending may experience periodic changes.

Nexo:

Description: Nexo represents a robust lending platform offering users the ability to earn interest across a spectrum of cryptocurrencies and fiat currencies. The platform boasts the backing of a company with substantial experience in lending, spanning over a decade.

Advantages:

- Competitive interest rates are a standout feature of the platform’s offerings.

- Comprehensive support for a wide array of cryptocurrencies and fiat currencies.

- Daily compound interest mechanism enhances earnings potential.

Limitations:

- Interest rates may vary based on the specific manner in which interest payments are received.

- Relative decentralization may not be as pronounced as in other platforms.

Understanding the Essence of Crypto Lending:

In a realm where the financial landscape is rapidly reshaping itself, traditional norms are continuously being challenged. Within this transformative milieu, the concept of crypto lending has emerged as an enigmatic phenomenon, holding the potential to reshape lending practices as we know them. Distinct from the convoluted processes often associated with procuring loans from traditional financial institutions, the essence of crypto lending introduces a streamlined and accessible conduit for both investors and borrowers to interact seamlessly within the digital realm. The following sections will aim to unveil the core essence of crypto lending, unraveling its intricacies and uncovering the manner in which it operates.

At its very core, crypto lending revolves around the notion of individuals leveraging their digital assets as collateral in exchange for loans. This practice ushers in a win-win situation, whereby lenders earn interest on the crypto they supply, while borrowers gain access to much-needed funds without being subjected to the extensive documentation and credit checks synonymous with traditional lending practices.

The Mechanics Underlying Crypto Lending: Embarking on an illustrative journey through a hypothetical scenario serves to elucidate the mechanics of crypto lending. Let us consider the protagonist, Steve, an ardent believer in the potential of cryptocurrencies. Steve’s portfolio includes two bitcoins, a testament to his belief in their long-term appreciation. However, he finds himself in a dilemma. While Steve harbors no intention of selling his bitcoins in the short term, he requires immediate funds to address certain financial obligations. This is where crypto lending platforms come into play, providing a potential solution to his quandary.

With crypto lending platforms as his guiding light, Steve takes a calculated step. He decides to employ his bitcoins as collateral, enabling him to apply for a loan denominated in stablecoins—a breed of cryptocurrencies pegged to the value of traditional assets. In the process, the platform mandates that Steve overcollateralizes the loan, necessitating a larger quantum of bitcoin holdings as collateral compared to the value of the loan extended to him. In this manner, the platform ensures a safety buffer that mitigates the risk of default.

As Steve diligently repays the loan, along with the agreed-upon interest, his bitcoins are returned to him in their entirety. This mechanism ensures that Steve retains full ownership of his cherished bitcoins while simultaneously utilizing the borrowed funds to address his immediate financial obligations.

Advantages of Crypto Lending:

The allure of crypto lending stems from a multitude of advantages that it offers to both lenders and borrowers, amplifying its appeal within the financial ecosystem.

- Accessibility: Unlike the conventional banking sphere, which places considerable emphasis on assessing credit scores, crypto lending platforms often dispense with the need for arduous credit checks. As a result, this avenue becomes accessible to a broader demographic, encompassing individuals devoid of a conventional financial history.

- Flexibility: A distinguishing feature of crypto lending platforms lies in the enhanced flexibility they provide in terms of repayment conditions. In contrast to the bureaucratic intricacies associated with traditional banks, transactions within these platforms are characterized by rapidity, and loan approvals can be granted in near-instantaneous fashion.

- Liquidity sans Tax Implications: For borrowers, the notion of tapping into the liquidity of their crypto holdings without triggering taxable events emerges as a compelling proposition. This facet ensures that individuals can access funds without resorting to the sale of their invaluable assets.

- Switching Between Crypto Assets: A key advantage offered by crypto lending platforms is the ability for users to transition between a diverse array of crypto assets that can serve as collateral. This not only grants users greater control over their holdings but also facilitates adaptability in the ever-evolving crypto landscape.

- Higher Interest Rates: One of the most captivating attributes of crypto lending platforms lies in the higher interest rates they frequently extend to participants. This stands in stark contrast to the relatively modest returns typically offered by traditional savings accounts, thereby fostering an environment where investors can potentially capitalize on their crypto holdings to a greater extent.

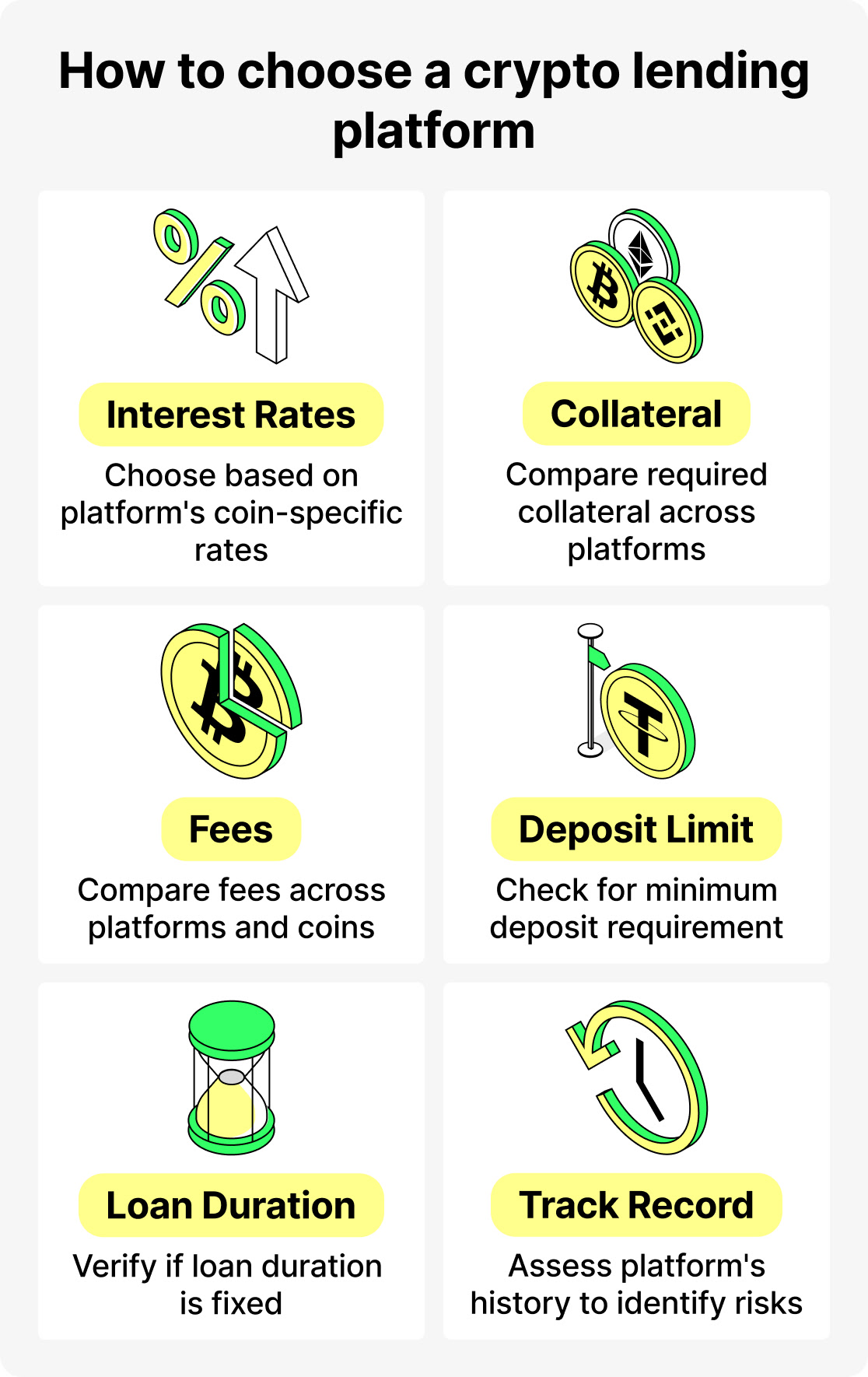

Tips on Choosing a Crypto Lending Platform

As you embark on a journey to select the ideal crypto lending platform tailored to your unique preferences and objectives, there exist several pivotal considerations that warrant careful evaluation. These considerations encompass the security of your assets, the scope of supported cryptocurrencies, the prevailing interest rates, collateral requisites, transparency in operations, regulatory adherence, and more. Additionally, the quality of customer support and the user experience presented by the platform should not be overlooked, as they significantly impact your overall engagement.

Security and Reputation:

- Prioritize platforms that have cultivated a robust reputation and garnered positive feedback from users within the community. Platforms with a sustained operational history, devoid of major security breaches or controversies, are often indicative of a trustworthy environment.

- Delve into the security measures implemented by the platform, encompassing practices such as cold storage for user funds, two-factor authentication (2FA) mechanisms, and advanced encryption protocols. Platforms that prioritize the safeguarding of assets tend to engender a higher degree of confidence among users.

Supported Cryptocurrencies:

- Scrutinize whether the platform aligns with the cryptocurrencies that you either currently hold or intend to deploy for lending or borrowing purposes. The variety of supported cryptocurrencies differs from platform to platform, making it essential to ascertain that your preferred assets find representation.

Interest Rates and Terms:

- Engage in a meticulous comparison of the interest rates extended to lenders and those imposed on borrowers across various platforms. Higher interest rates for lenders and lower rates for borrowers can significantly impact your earnings or borrowing costs.

- Familiarize yourself with the terms and conditions associated with loans, spanning repayment timelines and the potential imposition of penalties for late payments. Platforms offering a level of flexibility in terms tend to be more accommodating to your specific needs.

Collateral Requirements and LTV Ratio:

- If your interest lies in borrowing, pay careful attention to the collateral requirements and the corresponding loan-to-value (LTV) ratios enforced by the platform. A lower LTV ratio translates to a reduced necessity for collateral in proportion to the borrowed sum, thereby mitigating the risk of liquidation.

- Ensure that the collateral requisites are reasonable and do not expose you to unnecessary risks in the event of market fluctuations.

Transparency and Regulation:

- Prioritize platforms that exhibit transparency in their operational activities, fee structures, and lending procedures. Transparent communication is pivotal in facilitating a clear understanding of your involvement within the platform’s ecosystem.

- Additionally, evaluate whether the platform adheres to industry best practices or is subject to regulatory oversight. While decentralized platforms may not operate under the same regulatory framework as conventional financial institutions, those that conform to industry standards often provide an added layer of reassurance.

A Bonus Tip on User Experience and Customer Support: • User Experience: Factor in the quality of user experience offered by the platform’s interface. A user-friendly and intuitive platform design is instrumental in enabling you to effectively manage your lending and borrowing endeavors. • Customer Support: Consider the caliber of customer support extended by the platform. Responsive and helpful customer service can play a pivotal role in resolving any queries or addressing potential issues that may arise during your engagement with the platform.

Centralized vs. Decentralized Crypto Lending Platforms:

The crypto lending landscape bifurcates into two primary categories: centralized and decentralized platforms, each with its distinct characteristics and implications.

Centralized Platforms:

- Centralized platforms operate in accordance with regulatory frameworks, often necessitating user verification. These platforms tend to offer insurance for the assets deposited, engendering a heightened sense of security.

- Although centralized platforms involve more procedural steps, including documentation and verification, they provide users with a regulated environment that incorporates elements of traditional financial institutions.

Decentralized Finance (DeFi) Platforms:

- DeFi lending platforms, rooted in the decentralized ethos of the blockchain, function through the execution of smart contracts. These platforms offer a higher degree of privacy and

Leave a Reply

You must be logged in to post a comment.