Crypto business, including in the UK, has been booming in the past few years, giving a whole host of ways to make money. One of these ways, especially popular in the UK, is crypto lending, which lets people make money on their crypto holdings. If you’re just starting out in crypto lending, perhaps in the UK or elsewhere, you might be thinking: How does crypto lending work? Are crypto loans safe? Which are the top crypto lending platforms in the UK? Are crypto loans a good idea? What are the dangers of crypto lending in the UK?

Don’t fret. This guide gives you everything you need to know about crypto lending, focusing especially on the UK market. So, stay sharp and keep reading.

What is Crypto Lending?

Crypto lending, a popular thing in the UK and all over the world, is when investors make a bit of money every day, week, or month by lending their cryptos to people who want to borrow them. The interest rates can go as high as 17% per year, depending on the crypto being lent.

Crypto lending is great for investors, including those in the UK, who don’t want to sell their assets but still want to make some extra cash with the assets they’re not using. On top of that, investors can also take out loans in regular (e.g., GBP, USD, EUR, CAD) currency using their crypto assets if they need money and don’t want to sell their cryptos.

Crypto lending is available for lots of cryptocurrencies and stablecoins, like Bitcoin, Ethereum, Cardano, Litecoin, Binance Coin, USD Coin, True USD, and so on. The interest rate on cryptocurrencies is up to 7%, but for stablecoins, it can go as high as 17%.

How Does Crypto Lending Work in the UK?

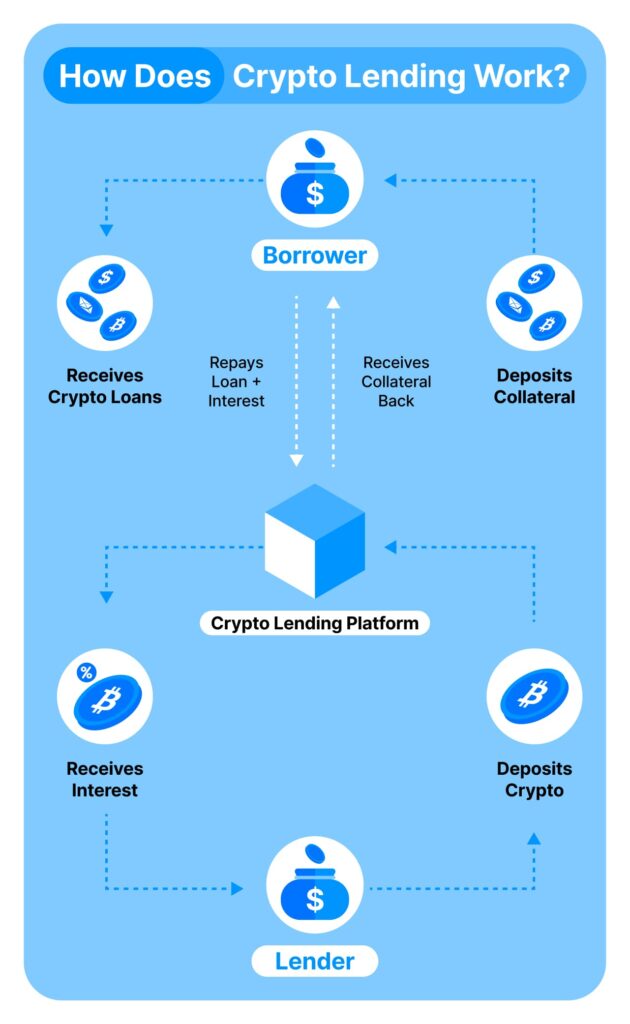

Crypto lending in the UK involves investors/lenders, borrowers, and a crypto lending platform. The whole lending process is pretty much the same on every platform, including those working in the UK.

A UK crypto lender puts his cryptos on a crypto exchange to make them available for lending at a set interest rate. A borrower asks for a loan through the platform. He has to use his cryptos as security. Once the platform gives the okay to the loan request, the money, either in regular currency or stablecoins, is automatically moved from the lender to the borrower’s account through the platform. The lender gets regular interest payments from the borrower.

The value of the security is 100% of the loan amount or usually even more, around 150% of the loan amount. A borrower can’t use his security until he pays back the whole loan. If the borrower doesn’t pay back the loan, the lender/platform can sell the security to make up for the losses.

The figure below shows the usual crypto lending process, as it works in the UK and other places.

Types of Crypto Loans in the UK

In the UK, like anywhere else, there are a few different types of crypto loans you can get, such as:

Crypto Loans with Collateral

Loans with collateral are the most common type of crypto loan in the UK and everywhere else. For these loans, the borrower has to put up some cryptocurrency as security to get the loan.

Most platforms in the UK need a security deposit that’s more than the loan amount (loan-to-value: LTV). That’s because if it wasn’t like this, the interest rate and the chance to cover losses would be lower.

Crypto Loans without Collateral

Loans without collateral in the UK are kind of like personal loans. They require borrowers to fill out a loan application and go through identity checks and credit checks to get the loan approved.

These loans are riskier for lenders, especially in the UK, because if the loan isn’t paid back, there’s no security to sell to cover the loss.

Flash Loans

Flash loans, popular in the UK and elsewhere, are super-fast loans that are borrowed and paid back all at once (in the same transaction).

These loans are risky and are usually used to take advantage of market arbitrage opportunities, like buying low in one market and instantly selling high in another. All of this happens in one transaction, even in the UK market.

Crypto Line of Credit

Crypto lines of credit are similar to loans with collateral and are offered by some platforms in the UK. With this type of loan, borrowers can get a loan for a certain percentage of the collateral they’ve put up, with no set date for when the loan has to be paid back.

Interest is only paid on the amount of money taken out. This type of loan is getting more and more popular with crypto fans in the UK.

Best Crypto Lending Platforms in the UK

There are a bunch of crypto lending platforms out there, including in the UK, but picking the best crypto lending platform is key because your whole lending experience depends on it.

So here we’ve listed a few things to think about before picking a crypto lending platform in the UK. Then we’ve compared the best crypto lending platforms working in the UK.

Things to Think About When Picking a Crypto Lending Platform in the UK

Comparison of the Best Crypto Lending Platforms

The following is a comparison of the best crypto lending platforms.

| Cropty Crypto Loans | YouHodler | Crypto.com | CoinLoan | Nexo | |

| Minimum Amount | 1$ | $100 | $250 | $100 | $10 |

| Lending Duration | Unlimited | Unlimited | Up to 90 Days | Up to 3 Years | Unlimited |

| Number of supported coins | 150 | 25 | 35 | 18 | 40 |

| Stablecoins Max APR % | 9% | 12.7% | 12% | 12.3% | Above 12% |

| Payout | When it suits | Weekly | Weekly | 1st Day of Month | Daily |

Cropty Crypto Loans

Cropty is a great choice for anyone looking to get into crypto lending. With a minimum amount of just $1, you can lend your crypto for as long as you like. They support an impressive 150 different coins, which is a lot more than most platforms. Their maximum APR for stablecoins is a competitive 9%, and you can cash out whenever it suits you best. This flexibility makes it a solid choice for beginners and experienced investors alike.

YouHodler

YouHodler is another excellent platform. You’ll need at least $100 to start lending, but like Cropty, there’s no limit on how long you can lend for. They support 25 different coins, which is less than Cropty but still gives you a good range of options. Their stablecoins max APR is a little higher at 12.7%, and they pay out weekly, which is nice and regular.

Crypto.com

Crypto.com requires a bit more investment upfront with a minimum amount of $250, but it’s a well-known platform that supports up to 35 different coins. However, their lending duration is limited to 90 days. The stablecoins max APR is decent at 12%, and they also pay out weekly, which allows you to regularly reinvest your earnings.

CoinLoan

CoinLoan offers lending duration up to 3 years, which is great for those who want to invest for a longer term. The minimum amount is $100, and they support 18 different coins. Their stablecoins max APR is competitive at 12.3%, and the payout is on the 1st day of the month, which can help with monthly budgeting.

Nexo

Nexo has the lowest minimum amount at just $10, and like Cropty and YouHodler, it offers unlimited lending duration. It supports 40 different coins and offers a max APR for stablecoins above 12%. However, what sets Nexo apart is its daily payout feature, which can be a significant advantage if you like to see regular returns.

In conclusion, the best platform for you depends on your specific needs and investment strategy. All these platforms are trusted in the crypto community and offer competitive rates and features. Whether you are new to crypto lending or an experienced investor, there’s a platform for everyone in this list.

Good and Bad Points of Crypto Loans in the UK

Like everything else, crypto lending in the UK comes with its own set of benefits and downsides. Here’s a quick glance at both sides.

Good Points:

- High Interest: Regular UK bank savings accounts usually offer interest rates around 3-4%, but crypto lending can offer a much higher interest rate of up to 17%.

- No Need to Lock In: Some UK crypto lending platforms offer high returns without making you lock your cryptos away for a set time.

- Signup Bonus: Many crypto lending platforms in the UK give bonuses in crypto or cash when you sign up and put money into the platform.

- No Credit Check: Borrowers don’t have to pass a credit check to get a loan in the UK. This means you can get a crypto loan even if you don’t have a bank account.

- Quick Cash: You can get money from a crypto loan in the UK in just a few hours, or at most, within a day.

Bad Points:

- No Deposit Insurance: Your crypto assets on the exchange are not insured by any UK deposit insurance scheme, so you’re taking a risk with your assets.

- Lockup Time: Some platforms in the UK require investors to put assets away for a certain time to earn interest. During this time, you can’t use your cryptos.

- You Lose Ownership: You have to hand over ownership of your crypto assets to the company and trust them with your assets. If the company closes down, you could lose everything.

- More Collateral Needed: As a borrower in the UK, if the value of collateral drops below the loan value, you will have to put in more collateral. Otherwise, you might lose your cryptos.

- Not Enough Insurance: If there’s a hacking event, the insurance provided by the platform might not cover all the money you put into the platform.

Risks of Crypto Lending in the UK

Whether you’re lending or borrowing, crypto lending in the UK carries some risks. Here are some of them:

- Margin Calls: If the value of collateral falls below the loan value, it can trigger a margin call in the UK. In this case, the borrower has to either deposit more collateral or the platform will sell it to cover losses.

- Illiquidity: Once you put your funds into a UK crypto lending platform for lending, you can’t use them. Some platforms let investors take out their deposited funds quite soon, but others may make you wait a long time.

- Lack of Protection: Unlike traditional UK banks, crypto lending platforms are not regulated in the same way. They don’t offer the same protections as banks. For instance, if a traditional bank goes under, the UK’s Financial Services Compensation Scheme (FSCS) insures up to £85,000 per account holder. But there’s no such protection in crypto lending. If the platform goes bust, users could lose all their funds.

- Smart Contract Risk: UK crypto lending platforms use smart contracts to automate lending processes like paying interest or selling collateral. These are code-based contracts that operate without human intervention. This means if something goes wrong with the smart contract, you’re on your own and could potentially lose your cryptos.

Is Crypto Lending Safe in the UK?

Despite the risks tied to crypto lending, it wouldn’t be entirely accurate to say it’s 100% safe. That said, there are ways to boost the safety of crypto lending.

To lessen risks and increase your potential profits, think about these tips:

- Keep up with crypto rules in your area or country, like the UK. If the rules change or if a platform gets in trouble with the law, you could lose your money.

- Choose a well-known and trusted crypto lending platform. The real deal platforms use strong methods and work with special providers to keep users’ money safe. Look into the platform’s safety rules to understand how your investment is protected.

- Pick stablecoins over cryptocurrencies for lending and borrowing. Cryptocurrencies can have big price changes, which could affect your ability to sell your coins if prices go down. On the other hand, borrowers may need to add more collateral if prices go up. Stablecoins, which are tied to things like the U.S. dollar or gold, don’t change in value like the crypto market does.

How to Get a Crypto Loan in the UK: Step-by-Step

Getting a crypto loan in the UK is pretty straightforward:

- Sign up on a crypto lending platform or connect your wallet to the platform.

- Pick the collateral to deposit and the amount you want to borrow.

- After you put the collateral on the platform, funds will be transferred to your account right away. You’ll typically get 50%-90% of your collateral.

Most crypto loans in the UK are approved instantly with set lock-up times using a smart contract.

If you’re interested in lending a crypto loan, the process is pretty similar. Just replace the step of depositing collateral with depositing funds for lending. Interest amounts will be automatically transferred to your account.

Conclusion

While crypto loans have their risks, you can lessen them by following the tips in this article. Doing your research is key to picking the best crypto lending platform in the UK, letting you earn high interest rates on your spare assets with little effort.

All posts

-

Top 5 Crypto Wallets to Store Cardano (ADA) in the UK and How to Choose Them

-

The Best Wallet for Avalanche: How to Choose the Right Option

-

How to Choose the Best Wallet for Polygon (POL)

-

How to Choose the Best Wallet for Solana (SOL)

-

How to choose the best wallet for Tron (TRX)?

-

The Best Wallet for NOT

-

The Best Wallet for TON

-

How to Choose the Best Wallet for Shiba Inu (SHIB)

-

How to Choose the Best Wallet for Bitcoin (BTC)

-

How to Choose the Best (Safest) Wallet for USDT